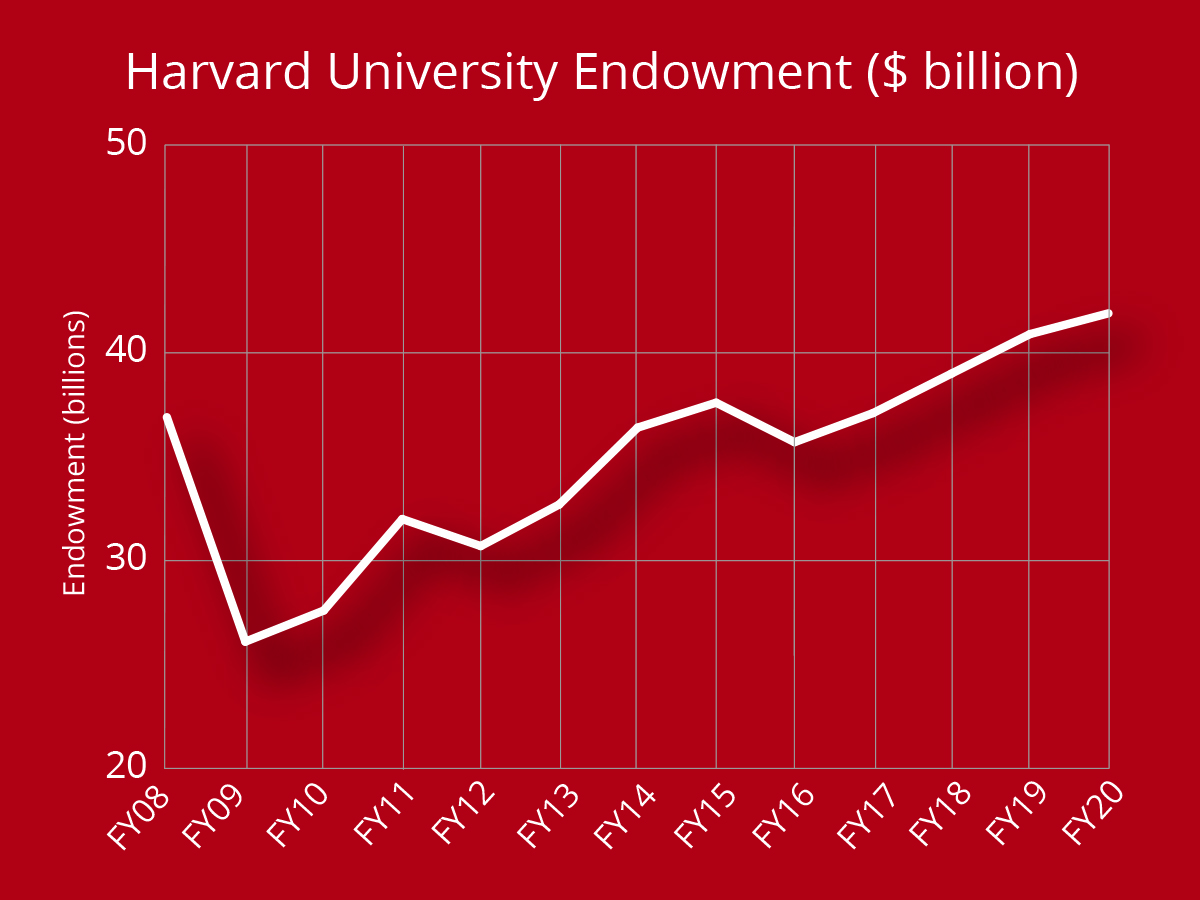

Harvard endowment management plays a crucial role in the financial landscape of Harvard University, impacting its overall finances and long-term sustainability. With an endowment valued at an impressive $53 billion, this financial resource is vital for the university’s budget planning and financial aid funding. However, the diverse restrictions imposed by donors complicate the immediate use of these funds, limiting their allocation to specific purposes like professorships and research initiatives. As university leaders navigate the complexities of endowment spending strategy, they must balance the immediate financial needs against the long-term investment goals that ensure future stability. The ongoing management and strategic deployment of these assets are essential as Harvard seeks to maintain its reputation as a leading educational institution while addressing economic challenges head-on.

The management of Harvard’s financial reserves, often referred to as the university’s endowment, is a critical aspect of how the institution sustains its operations and funding strategies. This substantial financial asset not only supports educational innovation but also serves as a safety net during economic fluctuations. As ongoing financial aid and university budget planning become increasingly challenging, thoughtful investment strategies are paramount. Understanding the nuances of endowment spending and its implications for future financial health is essential for maintaining Harvard’s legacy and academic excellence. In this landscape, the careful balancing of current expenditures against future returns is vital in ensuring that Harvard can adapt and thrive in light of changing financial tides.

Understanding Harvard University Finances

Harvard University, with its monumental endowment of over $53 billion, showcases a financial landscape that’s both complex and nuanced. While the sheer size of the endowment might suggest a wealth of resources available for any purpose, this perspective can be misleading. A significant portion of the funds is restricted by donors, particularly earmarked for specific schools or initiatives, limiting the university’s discretion over how the money can be spent. Understanding this structure is crucial for anyone looking to appreciate the intricacies of Harvard’s financial planning and overall budgeting strategies.

Moreover, the university’s financial framework reflects a delicate balance between immediate operational needs and the necessity for long-term planning. Financial aid funding represents a major allocation from the endowment, with a portion being devoted to maintaining competitive scholarships that foster diversity and accessibility. However, utilizing the endowment in response to urgent needs—such as increased financial aid—can lead to potential deficits in the future, underscoring the importance of sustainable budget strategies that prioritize both present and future institutional health.

The Role of Endowment Spending Strategy

Harvard University’s endowment spending strategy plays a pivotal role in shaping its financial health and operational success. By allocating around 5 percent of the endowment annually, the university can cover current expenditures while attempting to preserve the fund’s long-term viability. This strategy involves a careful calculation to ensure financial stability amidst varying economic conditions, which can often be unpredictable. Effective endowment management seeks to balance the pressing financial requirements of today with the goals set for future growth and development, allowing Harvard to strive for continued innovation and excellence.

This spending strategy isn’t without risks, particularly in the wake of external shocks such as economic downturns or political changes that threaten research funding. For instance, Harvard’s endowment management team anticipates the possibility of volatility in investment returns and responds by smoothing out spending over time rather than reacting instantaneously to market fluctuations. This tactic not only safeguards the university’s finances during crises but also positions it for long-term resilience, making it essential for stakeholders to understand and support these strategic decisions.

Financial Aid Funding at Harvard University

Financial aid funding is a critical aspect of Harvard’s budgeting and endowment strategy. Each year, a significant portion of the endowment is allocated to support scholarships aimed at lowering the cost barrier for students from diverse economic backgrounds. This commitment not only enhances Harvard’s accessibility but also reinforces its reputation as a leader in educational equity. By boosting financial aid, Harvard ensures that bright students from all walks of life can benefit from its world-class education, fostering a diverse student body that enriches the academic community.

However, the interplay between financial aid and the endowment’s overall management presents challenges. Increasingly generous aid packages require careful planning to avoid negatively impacting the endowment’s long-term stability. Therefore, university leaders must adeptly manage these funds to provide immediate benefits while securing future resources for upcoming generations. Appropriately balancing current financial aid demands with prudent fiscal actions is essential for maintaining the integrity and sustainability of Harvard’s educational mission.

Long-Term Investment Strategies at Harvard

Harvard University’s long-term investment strategies have long been a focal point of its financial leadership. With expectations of an 8 percent return on investments, the careful crafting of an investment portfolio involves diversification across several asset classes. This long-term outlook allows Harvard to weather fluctuating market conditions and maintain purchasing power over time. Successful investment strategies not only contribute to the endowment’s growth but also play a crucial role in funding various university initiatives ranging from research projects to campus development.

Incorporating a well-researched, forward-looking investment philosophy is essential for Harvard, especially in light of external economic factors. Investing with a long-term vision means that the university must prepare for potential downturns, ensuring that their strategies are resilient and adaptable. The ongoing commitment to smart investment practices underscores the importance of rigorous financial oversight, which is crucial for fostering Harvard’s status as a leading academic institution while ensuring its financial flexibility in the years to come.

Risks Associated with Endowment Management

The management of a substantial endowment like Harvard’s comes with inherent risks that can significantly impact the university’s financial stability. External economic shocks, such as financial crises or unexpected policy changes, can disrupt anticipated funding streams and alter investment returns. For instance, the recent threat of federal funding being frozen demands a reevaluation of existing financial strategies and projected revenue. Recognizing these risks is vital for university leaders to implement proactive measures that safeguard the institution’s financial health.

Mitigating risks involves not just strategic investment choices but also careful operational planning. Harvard must continually analyze potential threats to its funding model, whether from shifting political landscapes or economic downturns. In addition to maintaining a diversified investment portfolio, the university must also consider its sensitivity to changes in endowment policy, such as discussions about tax status and funding allocations. By embracing a comprehensive risk management approach, Harvard can foster a resilient economic environment that supports its commitment to excellence.

Scenario Analysis in University Budget Planning

Scenario analysis is a critical tool in the budget planning process at Harvard University, particularly in assessing the long-term implications of changes in funding and policy. As potential risks from external political and economic factors mount, understanding how alterations could influence the endowment and university finances becomes paramount. Harvard’s financial administrators are encouraged to employ robust scenario planning to anticipate various outcomes, leading to more informed decision-making that prioritizes sustainability and stability.

The importance of scenario analysis is highlighted by recent events that threatened established funding sources. By simulating different financial situations—such as a decrease in available research grants or changes in the endowment tax structure—university leaders can carefully evaluate their options and implications. This proactive strategy enables Harvard to devise a flexible and adaptive budget that remains responsive to both threats and opportunities, ensuring the university’s commitment to its educational mission continues unabated.

Impact of External Factors on Harvard’s Financial Stability

External factors, including government policies and global economic conditions, play a significant role in influencing Harvard’s financial stability. For example, the freeze of millions in federal research funding showcases how external government actions can have immediate repercussions on university finances. These fluctuations necessitate a robust financial framework capable of adapting to a dynamic landscape. In light of this, university leaders are tasked with considering how to buffer the institution against potential revenue losses.

This resilience is vital for ensuring that Harvard continues to fulfill its academic and operational commitments. A careful analysis of external factors should be integrated into both current budgeting processes and long-term investment strategies. By embracing a holistic approach, Harvard can fortify its financial infrastructure, preparing for uncertainties while pursuing sustained growth and innovation within its academic programs.

Strategic Directions for Future Endowment Management

Looking to the future, strategic directions for endowment management at Harvard are vital for sustaining its status as one of the preeminent academic institutions worldwide. As financial landscapes evolve, the university must continue to refine its investment practices and focus on sustainable budget planning. This may involve diversifying investment sources and exploring new asset classes that align with socially responsible practices, ensuring not only financial viability but also ethical consideration in its operations.

Moreover, engaging with the broader Harvard community, including alumni and stakeholders, can provide valuable insights and support for the endowment’s growth. By fostering a culture of transparency and collaboration, the university can encourage reciprocal investment in its mission, further strengthening its financial foundation as it navigates the complexities of modern education financing. This holistic approach to endowment management can enhance Harvard’s ability to respond to unforeseen challenges and capitalize on emerging opportunities.

The Future of Harvard Endowment Management

The future of Harvard’s endowment management will likely be characterized by a commitment to agility and resilience in an ever-evolving fiscal environment. As challenges such as political changes and economic fluctuations arise, university administrators must remain proactive in addressing financial strategy. This includes continuously assessing the endowment’s performance metrics, revisiting withdrawal rates, and exploring new avenues to enhance revenue while preserving core institutional values.

Additionally, the dialogue surrounding the endowment’s management must involve a broader engagement with the community and be reflective of evolving educational priorities. As Harvard navigates its path forward, the practices employed in managing its endowment will serve as a testament to its commitment to fostering sustainability, accessibility, and excellence. By continuing to innovate and adapt, Harvard can maintain its competitive edge and ensure its resources are maximized effectively for the benefit of future generations.

Frequently Asked Questions

What is the significance of Harvard endowment management in university budget planning?

Harvard endowment management plays a critical role in university budget planning by providing essential funding for various operational needs, including faculty salaries, research projects, and financial aid. It enables Harvard to strategically allocate resources while balancing immediate expenses against long-term investment goals. A well-managed endowment helps ensure the financial stability and adaptability of Harvard University amid changing financial landscapes.

How does Harvard University finances impact its endowment spending strategy?

Harvard University’s finances directly influence its endowment spending strategy. The university aims to maintain a sustainable payout rate that supports its programs without depleting future resources. This approach allows Harvard to address current financial needs while also preserving the endowment’s value for future generations, ensuring continued funding for vital areas like financial aid and academic programs.

In what ways does the endowment support financial aid funding at Harvard University?

The Harvard endowment significantly contributes to financial aid funding by covering a portion of the costs associated with its generous aid programs. Approximately one-fifth of the annual distributions from the endowment are allocated to financial aid, helping to make Harvard’s education accessible to a diverse range of students, regardless of their financial background.

What challenges does Harvard face in long-term investment related to its endowment?

One of the primary challenges in long-term investment for Harvard’s endowment involves managing market volatility and ensuring stable returns. Harvard anticipates an average investment return of around 8 percent per year, but external factors such as economic recessions, federal funding uncertainties, and geopolitical events can disrupt these projections, complicating planning and risk management.

How does Harvard’s endowment management adapt to external financial shocks?

Harvard’s endowment management adapts to external financial shocks by allowing for flexible distributions during crises, such as economic downturns or surprising political changes. This can involve increasing payout rates temporarily to address urgent needs, although such actions may require adjustments in future budgets to maintain financial sustainability.

What is the role of the Harvard Management Company in endowment management?

The Harvard Management Company oversees the endowment management, focusing on maximizing the fund’s investment returns while adhering to the restrictions placed by donors. By employing various investment strategies, the company aims to achieve long-term growth of the endowment, which is crucial for supporting Harvard’s diverse financial commitments and operational needs.

How does Harvard ensure the long-term stability of its endowment amid changing circumstances?

To ensure long-term stability, Harvard employs a framework for scenario analysis to assess potential financial challenges, such as loss of federal funding or changes in tax status. This proactive approach encourages careful planning, allowing the university to adjust its spending strategies and revenue sourcing as needed, thus maintaining its financial health and support for educational initiatives.

| Key Point | Description |

|---|---|

| Endowment Value | Harvard’s endowment reached a record $53 billion, but much of it is donor-restricted and limited in usage. |

| Funding Restrictions | Less than 5% of the endowment is unrestricted and can be used at the discretion of University leadership. |

| Budget Management | The endowment is currently being used to cover significant budget deficits in various programs. |

| Financial Aid | One-fifth of the annual endowment distribution supports financial aid for students. |

| External Shocks | The endowment can be tapped during emergencies, impacting future budgets. |

| Investment Strategy | Harvard aims for 8% investment returns, balancing spending and future needs. |

| Volatility Management | Harvard seeks to smooth out the effects of volatility rather than spending impulsively. |

| Long-Term Sustainability | Changes in federal funding and tax status may necessitate significant adjustments to spending. |

Summary

Harvard endowment management is crucial for navigating the complexities of funding amidst evolving financial landscapes. As the endowment reaches historic valuations, it is imperative to recognize that a significant portion of it is restricted and designed to support specific programs. This necessitates a balance between immediate financial needs and long-term strategic planning. With external pressures such as potential funding cuts and political changes, Harvard University must adopt a prudent approach to manage its resources effectively, ensuring sustainability and support for its mission.